Green Point remains one of Cape Town’s most vibrant and sought-after suburbs, balancing the buzz of city life with leafy streets and close proximity to the ocean. Over the past year, the property market here has been lively, with activity across sales, listings, and short-term rentals reflecting both local and international interest.

In this blog we cover:

- Sales Snapshot – How freestanding homes and sectional title properties have been performing, including average prices and time on the market.

- What’s Currently on the Market – What’s on the market right now in Green Point, from entry-level apartments to multi-million-rand luxury homes.

- Short-term rentals – A snapshot of the STR market, including revenue, occupancy, and bookings, showing the year-on-year growth.

- Market Overview – A summary of overall property activity and what the numbers tell us.

Sales Snapshot: The Past 12 Months

Green Point has seen solid activity across both freestanding and sectional title properties over the past twelve months.

Freestanding Residential Properties

- Total Sales: 49

- Average Sale Price: R10,235,936

- Highest Sale Price: R27,000,000

- Lowest Sale Price: R4,500,000

- Average Time on Market: 65 days

These numbers show that freestanding homes are in strong demand, moving relatively quickly and spanning a wide price range to suit different buyers.

Sectional Title Properties

- Total Sales: 171

- Average Sale Price: R4,249,415

- Highest Sale Price: R19,000,000

- Lowest Sale Price: R250,000

- Average Time on Market: 63 days

Sectional title properties continue to attract both investors and owner-occupiers, offering more affordable entry points into one of Cape Town’s most desirable suburbs.

What’s Currently on the Market

As of December 2025, there are 123 Green Point properties listed on Property24, with an average asking price of R6,200,000 and an average sale price of R3,850,000.

Most expensive property listed: R35,550,000

Lowest priced property listed: R2,195,000

Here’s a breakdown of average asking prices by bedroom count:

- 1 bed: R3,950,000

- 2 beds: R6,690,000

- 3 beds: R12,950,000

- 4 beds: R25,000,000

- 5+ beds: R17,225,000

The current listings reflect the diversity of the Green Point market, from modern city apartments to larger freestanding family homes, catering to a variety of lifestyles and budgets.

Short-Term Rentals

A look at the Green Point market as a whole

Estimated Average Revenue per Listing (Entire Market)

- Current Period: R443,360

- Previous Period: R382,880

This equates to an increase of 15.80% year-on-year.

Average Total Active Listings in the Market

- Current Period: 1,200

- Previous Period: 1,031

That means there were 169 more active listings in Green Point year-on-year.

Number of Bookings for Green Point

- Current Period: 37,040

- Previous Period: 29,440

That’s a 25.82% increase year-on-year.

Average Occupancy % in Green Point

- Current Period: 73%

- Previous Period: 71%

There has been a 2% increase year-on-year.

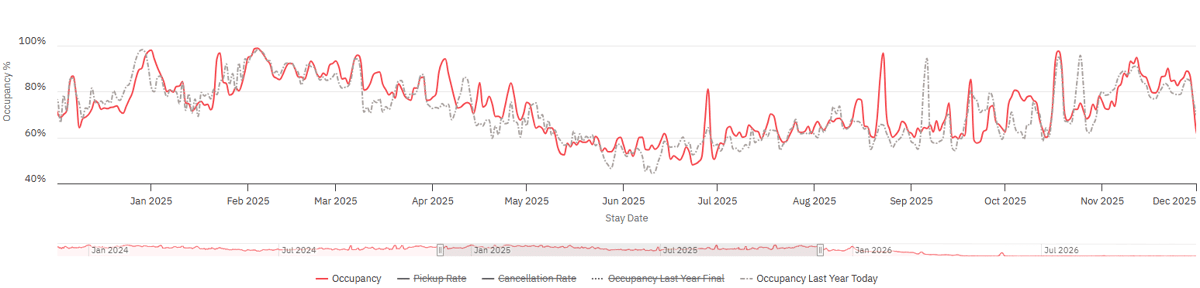

Occupancy for the previous 365 days

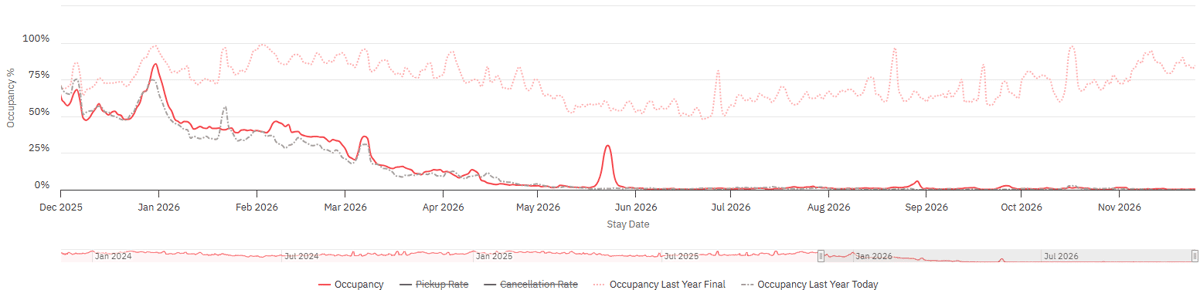

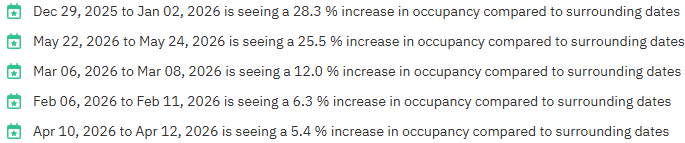

Occupancy for the upcoming 365 days

We see 2 great spikes for 2026 so far. The first being 6-8 March 2026, these are the Cape Town Argus Cycle Tour dates, which is a normal annual spike in occupancy. The second dates 22-24 May are currently planned for the Cape Town Marathon, which was sadly cancelled at the last minute this year.

Key Future Dates

The data highlights a growing short-term rental market, with more listings and higher revenue, while occupancy remains strong.

Market Overview

Overall, Green Point continues to offer something for everyone, whether you’re looking to buy, invest, or rent. Freestanding homes and sectional title properties are moving steadily, listings reflect a range of budgets, and the short-term rental market is thriving. The numbers suggest a suburb that is both desirable and dynamic, with healthy activity across all property types.

*Sources: CMA | PriceLabs | Property24

Looking for a Property Management Company?

If you’re looking for a property management company in Cape Town, check out Nox Cape Town. Our team specialises in optimising rental income, maintaining high occupancy, and ensuring premium guest experiences, helping property owners get the most from their investments.

.jpg?width=1962&height=1308&name=Panova%20(33).jpg)

%20(1).jpg?width=2000&height=1333&name=Ocean%20Vue%202000x1333%20(67)%20(1).jpg)